June 15 tax deadline postponed to July 15 for taxpayers who live and work abroad [税金]

Internal Revenue Service reminded people who live and work abroad that they have until Wednesday, July 15, 2020, to file their 2019 federal income tax return and pay any tax due. The usual deadline is June 15.

This extension was included in a wide range of Coronavirus-related relief announced in early April. The extension generally applies to all taxpayers who have an income tax filing or payment deadline falling on or after April 1, 2020, and before July 15, 2020.

This means that anyone, including Americans who live and work abroad, nonresident aliens and foreign entities with a U.S. filing and payment requirement, have until July 15 to file their 2019 federal income tax return and pay any tax due.

This extension was included in a wide range of Coronavirus-related relief announced in early April. The extension generally applies to all taxpayers who have an income tax filing or payment deadline falling on or after April 1, 2020, and before July 15, 2020.

This means that anyone, including Americans who live and work abroad, nonresident aliens and foreign entities with a U.S. filing and payment requirement, have until July 15 to file their 2019 federal income tax return and pay any tax due.

Economic Impact Payments [税金]

The IRS is regularly updating the Economic Impact Payment and the Get My Payment tool frequently asked questions pages on IRS.gov as more information becomes available.

Quick links to the Frequently Asked Questions on IRS.gov:

•Economic Impact Payments:

•Get My Payment tool:

No action needed by most taxpayers:

Eligible taxpayers who filed tax returns for 2019 or 2018 will receive the payments automatically. Starting this week, automatic payments are going to those receiving Social Security retirement, or disability (SSDI), and Railroad Retirement benefits, and recipients of SSI and Veterans Affairs or survivor benefits should receive their payments by mid-May.

Non-Filers:

The Non-Filers Enter Payment Info tool is helping millions of taxpayers successfully submit basic information to receive Economic Impact Payments quickly to their bank accounts. This tool is designed only for people who are not required to submit a tax return. It is available in English through Free File Fillable Forms and in Spanish through ezTaxReturn.

• Non-Filers Enter Payment Info tool

(Source of quote)

IR-2020-85, April 30, 2020

Quick links to the Frequently Asked Questions on IRS.gov:

•Economic Impact Payments:

•Get My Payment tool:

No action needed by most taxpayers:

Eligible taxpayers who filed tax returns for 2019 or 2018 will receive the payments automatically. Starting this week, automatic payments are going to those receiving Social Security retirement, or disability (SSDI), and Railroad Retirement benefits, and recipients of SSI and Veterans Affairs or survivor benefits should receive their payments by mid-May.

Non-Filers:

The Non-Filers Enter Payment Info tool is helping millions of taxpayers successfully submit basic information to receive Economic Impact Payments quickly to their bank accounts. This tool is designed only for people who are not required to submit a tax return. It is available in English through Free File Fillable Forms and in Spanish through ezTaxReturn.

• Non-Filers Enter Payment Info tool

(Source of quote)

IR-2020-85, April 30, 2020

申告期限延長のお知らせ(Deadline is postponed to July 15) [税金]

いつもブログに訪問いただき有り難うございます。

この度の新型コロナウィルスの感染拡大により生活に大きな影響を受けられている方がほとんどではないでしょうか?

時節柄ご自愛頂けますようにお願い申し上げます。

さて、例年この時期のブログでは“申告期限に間に合いそうにない方へ延長申請のご案内”をしておりましたが、今回のブログでは“申告期限が延長されたことをご案内”させて頂きます。

この度の新型コロナウィルスの感染拡大により生活に大きな影響を受けられている方がほとんどではないでしょうか?

時節柄ご自愛頂けますようにお願い申し上げます。

さて、例年この時期のブログでは“申告期限に間に合いそうにない方へ延長申請のご案内”をしておりましたが、今回のブログでは“申告期限が延長されたことをご案内”させて頂きます。

Five steps taxpayers can take now to protect against identity theft [税金]

All taxpayers should make sure they're doing everything they can to prevent a thief from stealing their identity.

Tax-related ID theft occurs when someone uses a taxpayer's stolen personal information to file a tax return claiming a fraudulent refund. The thieves use personal information like a stolen Social Security number.

Here are some tips to help taxpayers protect themselves against identity theft. Taxpayers should:

Tax-related ID theft occurs when someone uses a taxpayer's stolen personal information to file a tax return claiming a fraudulent refund. The thieves use personal information like a stolen Social Security number.

Here are some tips to help taxpayers protect themselves against identity theft. Taxpayers should:

"Start of acceptance of 2019 individual income tax return" [税金]

From Monday, January 27, U.S. time, IRS is starting to accept individual income tax return (Form 1040) . The filing deadline is Wednesday, April 15. However, if you live outside the United States, Form 1040 is extended an automatic two months' extension . It will be until Monday, June 15.

---------------------------------------------------------------------------------------------------------------------------------

米国時間の1月27日(月)よりIRS(米内国歳入庁)よる個人所得税申告書類(Individual Income Tax Return)の受け付けが開始しております。

申告期限は、4月15日(水)までとなります。

ただし、米国外にお住まいの方には申告書類の提出期限は2か月の自動延長があり、6月15日(月)までとなります。

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Written by

Office T.Professional

米国税理士 小野 知史(Tomofumi Ono)

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

---------------------------------------------------------------------------------------------------------------------------------

米国時間の1月27日(月)よりIRS(米内国歳入庁)よる個人所得税申告書類(Individual Income Tax Return)の受け付けが開始しております。

申告期限は、4月15日(水)までとなります。

ただし、米国外にお住まいの方には申告書類の提出期限は2か月の自動延長があり、6月15日(月)までとなります。

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Written by

Office T.Professional

米国税理士 小野 知史(Tomofumi Ono)

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

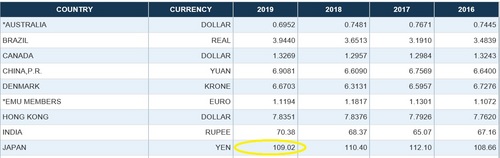

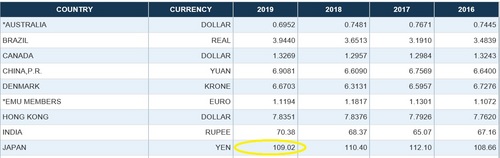

“2019年換算レート(Currency Exchange Rates)”について [税金]

昨年中はブログに訪問いただき有り難うございました。本年もご愛顧いただけますようにお願い申し上げます。

さて、Federal Reserve Bank(FRB)より1月2日に発表がありました外国為替レート(Foreign Exchange Rates)をご案内させて頂きます。

下記の換算レートは、米国外の通貨を米国㌦に換算する際に使用するものになります。

(FRB:Board of Governors of the Federal Reserve System)

1米国㌦=109.02円となります。

FRB以外にも以下のサイトにて案内されている組織により発表された換算レートも使用可能です。

Foreign Currency and Currency Exchange Rates

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Written by

Office T.Professional

米国税理士 小野 知史(Tomofumi Ono)

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

さて、Federal Reserve Bank(FRB)より1月2日に発表がありました外国為替レート(Foreign Exchange Rates)をご案内させて頂きます。

下記の換算レートは、米国外の通貨を米国㌦に換算する際に使用するものになります。

(FRB:Board of Governors of the Federal Reserve System)

1米国㌦=109.02円となります。

FRB以外にも以下のサイトにて案内されている組織により発表された換算レートも使用可能です。

Foreign Currency and Currency Exchange Rates

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Written by

Office T.Professional

米国税理士 小野 知史(Tomofumi Ono)

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

年始のご挨拶(New Year's Greetings) [税金]

新年あけましておめでとうございます。

皆様には、健やかに新春を迎えられたことと、お慶び申し上げます。 旧年中はひとかたならぬご厚情をいただきありがとうございます。

本年も変わらぬお引き立ての程よろしくお願い申し上げます。

皆様のご健勝とご発展をお祈り申し上げます。

------------------------------------------------------------------------------------------------

Happy New Year.

I would like to congratulate you on the healthy new year.

Thank you very much for your kindness during last year and for your continued support this year.

I wish you good health and development.

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Written by

Office T.Professional

米国税理士 小野 知史(Tomofumi Ono)

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

皆様には、健やかに新春を迎えられたことと、お慶び申し上げます。 旧年中はひとかたならぬご厚情をいただきありがとうございます。

本年も変わらぬお引き立ての程よろしくお願い申し上げます。

皆様のご健勝とご発展をお祈り申し上げます。

------------------------------------------------------------------------------------------------

Happy New Year.

I would like to congratulate you on the healthy new year.

Thank you very much for your kindness during last year and for your continued support this year.

I wish you good health and development.

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Written by

Office T.Professional

米国税理士 小野 知史(Tomofumi Ono)

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Taxpayers can take steps now to Get Ready to file their taxes in 2020 [税金]

There are steps people can take now to make sure their tax filing experience goes smoothly next year.

Here are a few other things people can do now:

Check their withholding and make any adjustments soon

Since most employees typically only have a few pay dates left this year, checking their withholding soon is especially important. It's even more important for those who:

•Received a smaller refund than expected after filing their 2018 taxes this year.

•Owed an unexpected tax bill last year.

•Experienced personal or financial changes that might change their tax liability.

Some people may owe an unexpected tax bill when they file their 2019 tax return next year. To avoid this kind of surprise, taxpayers should use the Tax Withholding Estimator to perform a quick paycheck or pension income checkup. Doing so helps them decide if they need to adjust their withholding or make estimated or additional tax payments now.

Gather documents

Everyone should come up with a recordkeeping system. Whether it's electronic or paper, they should use a system to keep all important information in one place. Having all needed documents on hand before they prepare their return helps them file a complete and accurate tax return. This includes:

•Their 2018 tax return.

•Forms W-2 from employers.

•Forms 1099 from banks and other payers.

•Forms 1095-A from the marketplace for those claiming the premium tax credit.

Confirm mailing and email addresses

To make sure these forms make it to the taxpayer on time, people should confirm now that each employer, bank and other payer has the taxpayer's current mailing address or email address. Typically, forms start arriving by mail or are available online in January. People should keep copies of tax returns and all supporting documents for at least three years. Also, taxpayers using a software product for the first time may need the adjusted gross income amount from their 2018 return to validate their electronically filed 2019 return.

(Source of quote)

IRS Tax Tip 2019-161

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Edited by

Office T.Professional

米国税理士 小野 知史(Tomofumi Ono)

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Here are a few other things people can do now:

Check their withholding and make any adjustments soon

Since most employees typically only have a few pay dates left this year, checking their withholding soon is especially important. It's even more important for those who:

•Received a smaller refund than expected after filing their 2018 taxes this year.

•Owed an unexpected tax bill last year.

•Experienced personal or financial changes that might change their tax liability.

Some people may owe an unexpected tax bill when they file their 2019 tax return next year. To avoid this kind of surprise, taxpayers should use the Tax Withholding Estimator to perform a quick paycheck or pension income checkup. Doing so helps them decide if they need to adjust their withholding or make estimated or additional tax payments now.

Gather documents

Everyone should come up with a recordkeeping system. Whether it's electronic or paper, they should use a system to keep all important information in one place. Having all needed documents on hand before they prepare their return helps them file a complete and accurate tax return. This includes:

•Their 2018 tax return.

•Forms W-2 from employers.

•Forms 1099 from banks and other payers.

•Forms 1095-A from the marketplace for those claiming the premium tax credit.

Confirm mailing and email addresses

To make sure these forms make it to the taxpayer on time, people should confirm now that each employer, bank and other payer has the taxpayer's current mailing address or email address. Typically, forms start arriving by mail or are available online in January. People should keep copies of tax returns and all supporting documents for at least three years. Also, taxpayers using a software product for the first time may need the adjusted gross income amount from their 2018 return to validate their electronically filed 2019 return.

(Source of quote)

IRS Tax Tip 2019-161

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Edited by

Office T.Professional

米国税理士 小野 知史(Tomofumi Ono)

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

2 million ITINs set to expire in 2019; to avoid refund delays apply soon [税金]

Taxpayers with expiring Individual Taxpayer Identification Numbers (ITINs) can get their ITINs renewed more quickly and avoid refund delays next year by submitting their renewal application soon.

An ITIN is a tax ID number used by taxpayers who don't qualify to get a Social Security number. Any ITIN with middle digits 83, 84, 85, 86 or 87 will expire at the end of this year. In addition, any ITIN not used on a tax return in the past three years will expire. As a reminder, ITINs with middle digits 70 through 82 that expired in 2016, 2017 or 2018 can also be renewed.

The IRS urges anyone affected to file a complete renewal application, Form W-7, Application for IRS Individual Taxpayer Identification Number, as soon as possible. Be sure to include all required ID and residency documents. Failure to do so will delay processing until the IRS receives these documents. With nearly 2 million taxpayer households impacted, applying now will help avoid the rush as well as refund and processing delays in 2020.

An ITIN is a tax ID number used by taxpayers who don't qualify to get a Social Security number. Any ITIN with middle digits 83, 84, 85, 86 or 87 will expire at the end of this year. In addition, any ITIN not used on a tax return in the past three years will expire. As a reminder, ITINs with middle digits 70 through 82 that expired in 2016, 2017 or 2018 can also be renewed.

The IRS urges anyone affected to file a complete renewal application, Form W-7, Application for IRS Individual Taxpayer Identification Number, as soon as possible. Be sure to include all required ID and residency documents. Failure to do so will delay processing until the IRS receives these documents. With nearly 2 million taxpayer households impacted, applying now will help avoid the rush as well as refund and processing delays in 2020.

The filing deadline for extension filers is almost here [税金]

It’s almost here…the filing deadline for taxpayers who requested an extension to file their 2018 tax return.

This year’s deadline is Tuesday, October 15.

Even though time before the extension deadline is dwindling, there’s still time for taxpayers to file a complete and accurate return.

Taxpayers should remember they don’t have to wait until October 15 to file.

They can file whenever they are ready.

Taxpayers who did not request an extension and have yet to file a 2018 tax return can generally avoid additional penalties and interest by filing the return as soon as possible and paying the amount owed.

(Source of quote)

IRS Tax Tip 2019-132

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Edited by

Office T.Professional

米国税理士 小野 知史(Tomofumi Ono)

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

This year’s deadline is Tuesday, October 15.

Even though time before the extension deadline is dwindling, there’s still time for taxpayers to file a complete and accurate return.

Taxpayers should remember they don’t have to wait until October 15 to file.

They can file whenever they are ready.

Taxpayers who did not request an extension and have yet to file a 2018 tax return can generally avoid additional penalties and interest by filing the return as soon as possible and paying the amount owed.

(Source of quote)

IRS Tax Tip 2019-132

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Edited by

Office T.Professional

米国税理士 小野 知史(Tomofumi Ono)

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■