前の10件 | -

Get ahead of the tax deadline; act now to file, pay or request an extension [税金]

With the April 15 tax deadline approaching, the IRS reminds taxpayers there is still time file their federal income tax return and request direct deposit.

Taxpayers that owe on their tax return

IRS reminds people they can avoid paying interest and some penalties by filing their tax return and, if they have a balance due, paying the total amount due by the tax deadline of Monday, April 15. For residents of Maine or Massachusetts, the tax deadline is Wednesday, April 17, due to Patriot’s Day and Emancipation Day holidays.

Unable to file by the April 15 deadline?

Individuals unable to file their tax return by the tax deadline can apply for a tax-filing extension in the following ways:

•Individual tax filers, regardless of income, can request an automatic tax-filing a Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

•Make an electronic payment using Direct Pay, debit card, credit card or digital wallet and indicate the payment is for an extension.

•Mail Form 4868 by the tax deadline.

Things people should know when requesting a tax-filing extension:

•Tax-filing extension requests are due by the tax deadline date, and it does not give an extension of time to pay the taxes.

•Avoid some penalties by estimating and paying the tax due by the tax deadline.

(Source of quote)

IR-2024-88, April 2, 2024

Taxpayers that owe on their tax return

IRS reminds people they can avoid paying interest and some penalties by filing their tax return and, if they have a balance due, paying the total amount due by the tax deadline of Monday, April 15. For residents of Maine or Massachusetts, the tax deadline is Wednesday, April 17, due to Patriot’s Day and Emancipation Day holidays.

Unable to file by the April 15 deadline?

Individuals unable to file their tax return by the tax deadline can apply for a tax-filing extension in the following ways:

•Individual tax filers, regardless of income, can request an automatic tax-filing a Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

•Make an electronic payment using Direct Pay, debit card, credit card or digital wallet and indicate the payment is for an extension.

•Mail Form 4868 by the tax deadline.

Things people should know when requesting a tax-filing extension:

•Tax-filing extension requests are due by the tax deadline date, and it does not give an extension of time to pay the taxes.

•Avoid some penalties by estimating and paying the tax due by the tax deadline.

(Source of quote)

IR-2024-88, April 2, 2024

Deductions for individuals: What they mean and the difference between standard and itemized deductions [税金]

A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have to pay. Most taxpayers now qualify for the standard deduction, but there are some important details involving itemized deductions that people should keep in mind.

Standard deduction

The standard deduction is a specific dollar amount that reduces the amount of taxable income. The standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and/or blindness.

In general, the IRS adjusts the standard deduction each year for inflation. It varies by filing status, whether the taxpayer is 65 or older and/or blind and whether another taxpayer can claim them as a dependent.

Taxpayers cannot take the standard deduction if they itemize their deductions.

Itemized deductions

Some taxpayers choose to itemize their deductions if their allowable itemized deductions total is greater than their standard deduction. Other taxpayers must itemize deductions because they aren't entitled to use the standard deduction.

Taxpayers who must itemize deductions include:

•A married individual filing as married filing separately whose spouse itemizes deductions.

•An individual who was a nonresident alien or dual status alien during the year (some exceptions apply).

•An individual who files a return for a period of less than 12 months due to a change in his or her annual accounting period.

•An estate or trust, common trust fund or partnership.

Schedule A (Form 1040) for itemized deductions

Taxpayers use Schedule A (Form 1040 or 1040-SR) to figure their itemized deductions. In most cases, their federal income tax owed will be less if they take the larger of their itemized deductions or standard deduction.

Taxpayers can review the instructions for Schedule A (Form 1040), Itemized Deductions, to calculate their itemized deductions, such as certain medical and dental expenses, and amounts paid for certain taxes, interest, contributions and other expenses. Taxpayers may also deduct certain casualty and theft losses on Schedule A.

(Source of quote)

FS-2023-10, April 2023

Standard deduction

The standard deduction is a specific dollar amount that reduces the amount of taxable income. The standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and/or blindness.

In general, the IRS adjusts the standard deduction each year for inflation. It varies by filing status, whether the taxpayer is 65 or older and/or blind and whether another taxpayer can claim them as a dependent.

Taxpayers cannot take the standard deduction if they itemize their deductions.

Itemized deductions

Some taxpayers choose to itemize their deductions if their allowable itemized deductions total is greater than their standard deduction. Other taxpayers must itemize deductions because they aren't entitled to use the standard deduction.

Taxpayers who must itemize deductions include:

•A married individual filing as married filing separately whose spouse itemizes deductions.

•An individual who was a nonresident alien or dual status alien during the year (some exceptions apply).

•An individual who files a return for a period of less than 12 months due to a change in his or her annual accounting period.

•An estate or trust, common trust fund or partnership.

Schedule A (Form 1040) for itemized deductions

Taxpayers use Schedule A (Form 1040 or 1040-SR) to figure their itemized deductions. In most cases, their federal income tax owed will be less if they take the larger of their itemized deductions or standard deduction.

Taxpayers can review the instructions for Schedule A (Form 1040), Itemized Deductions, to calculate their itemized deductions, such as certain medical and dental expenses, and amounts paid for certain taxes, interest, contributions and other expenses. Taxpayers may also deduct certain casualty and theft losses on Schedule A.

(Source of quote)

FS-2023-10, April 2023

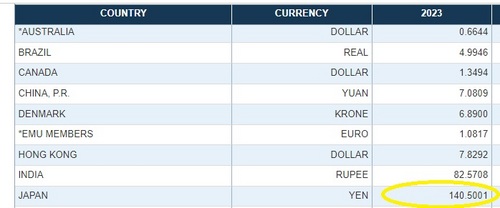

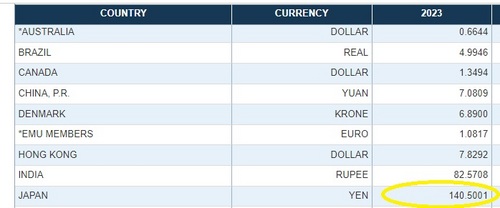

【更新】税金申告に使用する換算レートについて [税金]

例年では1月上旬にFRB(連邦準備制度理事会)より前年中の年間の平均為替レートが発表されておりましたが、ようやくFRBの2023年の年間の平均為替レートが分かりましたのでご案内させて頂きます。

2023年の連邦税、州税申告書類で使用する換算レートは、1米国㌦=140.50円となります。

今回の発表前にすでに書類作成に着手させて頂いておりますお客さまは、IRSが発表しております年間の平均為替レートの1米国㌦=140.51円で書類作成を進めさせて頂きます。

何卒ご理解頂けますようにお願い申し上げます。

2023年の連邦税、州税申告書類で使用する換算レートは、1米国㌦=140.50円となります。

今回の発表前にすでに書類作成に着手させて頂いておりますお客さまは、IRSが発表しております年間の平均為替レートの1米国㌦=140.51円で書類作成を進めさせて頂きます。

何卒ご理解頂けますようにお願い申し上げます。

税金申告に使用する換算レートについて [税金]

換算レートの件、お客さまになかなかご連絡出来ずにご不便をおかけしております。

弊所でお客さまより税金申告書類の作成のご依頼を承る場合には、FRB(連邦準備制度理事会)が発表する年間の平均為替レートを使用しておりますが、あいにく本日時点でも発表されておりません。

もう少し待ってもFRBの為替レートが分からない場合には、IRSのホームページ内で発表されている年間平均為替レートを使いお客さまの税金申告書類を開始させて頂きます。

IRSのホームページ内で発表されている2023年の為替レートは、1㌦=140.51円となります。

弊所でお客さまより税金申告書類の作成のご依頼を承る場合には、FRB(連邦準備制度理事会)が発表する年間の平均為替レートを使用しておりますが、あいにく本日時点でも発表されておりません。

もう少し待ってもFRBの為替レートが分からない場合には、IRSのホームページ内で発表されている年間平均為替レートを使いお客さまの税金申告書類を開始させて頂きます。

IRSのホームページ内で発表されている2023年の為替レートは、1㌦=140.51円となります。

年始のご挨拶 [業務連絡]

新年あけましておめでとうございます。

皆様には、健やかに新春を迎えられたことと、お慶び申し上げます。 旧年中はひとかたならぬご厚情をいただきありがとうございます。 本年も変わらぬお引き立ての程よろしくお願い申し上げます。 皆様のご健勝とご発展をお祈り申し上げます。

---------------------------------------------------------------------

New Year's Greetings

Happy New Year. I would like to congratulate you on the healthy new year. Thank you very much for your kindness during last year and for your continued support this year. I wish you good health and development.

皆様には、健やかに新春を迎えられたことと、お慶び申し上げます。 旧年中はひとかたならぬご厚情をいただきありがとうございます。 本年も変わらぬお引き立ての程よろしくお願い申し上げます。 皆様のご健勝とご発展をお祈り申し上げます。

---------------------------------------------------------------------

New Year's Greetings

Happy New Year. I would like to congratulate you on the healthy new year. Thank you very much for your kindness during last year and for your continued support this year. I wish you good health and development.

Publications help taxpayers get ready and stay ready for tax filing season [税金]

With the tax filing season almost here, taxpayers should check out two IRS publications available on IRS.gov. These publications can help people get prepared and stay organized with tips for year-round tax planning.

Publication 5348,Get ready to file

Tax planning is for everyone. Taxpayers can use this publication to help themselves get ready to file their 2023 federal income tax return next year. Planning helps individuals file an accurate return and avoid processing delays that can slow their tax refund.

Publication 5349, Year-round tax planning is for everyone

Life changes can affect taxpayers' expected refunds or the amount of tax they owe. These changes include things such as employment status, marital status and financial gains or losses. Publication 5349 provides tips on developing habits throughout the year that will help make tax preparation easier. This resource also includes a checklist of items taxpayers should have on hand when filing their tax return.

(Source of quote)

IRS Tax Tip 2021-186

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Edited by

Office T.Professional

米国税理士 小野 知史(Tomofumi Ono)

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Publication 5348,Get ready to file

Tax planning is for everyone. Taxpayers can use this publication to help themselves get ready to file their 2023 federal income tax return next year. Planning helps individuals file an accurate return and avoid processing delays that can slow their tax refund.

Publication 5349, Year-round tax planning is for everyone

Life changes can affect taxpayers' expected refunds or the amount of tax they owe. These changes include things such as employment status, marital status and financial gains or losses. Publication 5349 provides tips on developing habits throughout the year that will help make tax preparation easier. This resource also includes a checklist of items taxpayers should have on hand when filing their tax return.

(Source of quote)

IRS Tax Tip 2021-186

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Edited by

Office T.Professional

米国税理士 小野 知史(Tomofumi Ono)

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

Good recordkeeping year-round helps taxpayers avoid tax time frustration [税金]

Wading through a pile of statements, receipts and other financial documents when it's time to prepare a tax return can be frustrating for people who haven't managed their records. By knowing what they need to keep and how long to keep it, people can develop a good recordkeeping system year-round and make filing their return easier.

Good recordkeeping can also help taxpayers understand their situation when they receive letters or notices from the IRS.

Good records help:

•Identify sources of income. Taxpayers may receive money or property from a variety of sources. The records can identify the sources of income and help separate business from non-business income and taxable from nontaxable income.

•Keep track of expenses. Taxpayers can use records to identify expenses for which they can claim a deduction. This will help determine whether to itemize deductions at filing. It may also help them discover potentially overlooked deductions or credits.

•Prepare tax returns. Good records help taxpayers file their tax return quickly and accurately. Throughout the year, they should add tax records to their files as they receive them to make preparing a tax return easier.

•Support items reported on tax returns. Well-organized records make it easier to prepare a tax return and help provide answers if the return is selected for examination or if the taxpayer receives an IRS notice.

In general, taxpayers should keep records for three years from the date they filed the tax return. Taxpayers should develop a system that keeps all their important information together. They can use a software program for electronic recordkeeping. They could also store paper documents in labeled folders.

Records to keep include:

•Tax-related records. This includes wage and earning statements from all employers or payers including payment apps or cards, such as Form W-2, 1099-K, 1099-Misc, 1099-NEC. Other records include interest and dividend statements from banks, certain government payments like unemployment compensation, other income documents and records of virtual currency transactions. Taxpayers should also keep receipts, canceled checks, and other documents that support income, a deduction, or a credit reported on their tax return.

•IRS letters, notices and prior year tax returns. Taxpayers should keep copies of prior year tax returns and notices or letters they receive from the IRS. These include adjustment notices when an action takes place occurs on the taxpayer's account.

•Property records. Taxpayers should also keep records relating to property they dispose of or sell. They must keep these records to figure their basis for computing gain or loss.

•Business income and expenses. Business taxpayers should find a bookkeeping method that clearly and accurately reflects their gross income and expenses. Taxpayers who have employees must keep all employment tax records for at least four years after the tax is due or paid, whichever is later.

•Health insurance. Taxpayers should keep records of their own and their family members' health care insurance coverage. If they're claiming the premium tax credit, they'll need information about any advance credit payments received through the Health Insurance Marketplace and the premiums they paid.

(Source of quote)

IRS Tax Tip 2022-183, November 30, 2022

Good recordkeeping can also help taxpayers understand their situation when they receive letters or notices from the IRS.

Good records help:

•Identify sources of income. Taxpayers may receive money or property from a variety of sources. The records can identify the sources of income and help separate business from non-business income and taxable from nontaxable income.

•Keep track of expenses. Taxpayers can use records to identify expenses for which they can claim a deduction. This will help determine whether to itemize deductions at filing. It may also help them discover potentially overlooked deductions or credits.

•Prepare tax returns. Good records help taxpayers file their tax return quickly and accurately. Throughout the year, they should add tax records to their files as they receive them to make preparing a tax return easier.

•Support items reported on tax returns. Well-organized records make it easier to prepare a tax return and help provide answers if the return is selected for examination or if the taxpayer receives an IRS notice.

In general, taxpayers should keep records for three years from the date they filed the tax return. Taxpayers should develop a system that keeps all their important information together. They can use a software program for electronic recordkeeping. They could also store paper documents in labeled folders.

Records to keep include:

•Tax-related records. This includes wage and earning statements from all employers or payers including payment apps or cards, such as Form W-2, 1099-K, 1099-Misc, 1099-NEC. Other records include interest and dividend statements from banks, certain government payments like unemployment compensation, other income documents and records of virtual currency transactions. Taxpayers should also keep receipts, canceled checks, and other documents that support income, a deduction, or a credit reported on their tax return.

•IRS letters, notices and prior year tax returns. Taxpayers should keep copies of prior year tax returns and notices or letters they receive from the IRS. These include adjustment notices when an action takes place occurs on the taxpayer's account.

•Property records. Taxpayers should also keep records relating to property they dispose of or sell. They must keep these records to figure their basis for computing gain or loss.

•Business income and expenses. Business taxpayers should find a bookkeeping method that clearly and accurately reflects their gross income and expenses. Taxpayers who have employees must keep all employment tax records for at least four years after the tax is due or paid, whichever is later.

•Health insurance. Taxpayers should keep records of their own and their family members' health care insurance coverage. If they're claiming the premium tax credit, they'll need information about any advance credit payments received through the Health Insurance Marketplace and the premiums they paid.

(Source of quote)

IRS Tax Tip 2022-183, November 30, 2022

Tax basics for setting up a business [税金]

Starting a new business can seem overwhelming for new entrepreneurs or even seasoned professionals. The IRS has resources to help new business owners understand the tax responsibilities of running a business.

Here are a few things any entrepreneur needs to do when starting their business.

1.Choose a business structure

The form of business determines which income tax return a business needs to file. The most common business structures are:

•Sole proprietorship: An unincorporated business owned by an individual. There's no distinction between the taxpayer and their business.

•Partnership: An unincorporated business with ownership shared between two or more members.

•Corporation: Also known as a C corporation. It's a separate entity owned by shareholders.

•S Corporation: A corporation that elects to pass corporate income, losses, deductions and credits through to the shareholders.

•Limited Liability Company: A business structure allowed by state statute. If a single-member LLC does not elect to be treated as a corporation, the LLC is a "disregarded entity," and the LLC's activities should be reflected on its owner's federal tax return as a sole proprietorship.

Choose a tax year

A tax year is an annual accounting period for keeping records and reporting income and expenses. A new business owner must choose either:

•Calendar year: 12 consecutive months beginning January 1 and ending December 31.

•Fiscal year: 12 consecutive months ending on the last day of any month except December.

If an individual files their first tax return using the calendar tax year and later begins business as a sole proprietor, becomes a partner in a partnership, or becomes a shareholder in an S corporation, they must continue to use a calendar tax year unless they get IRS approval to change it or meet one of the exceptions listed in the instructions to Form 1128, Application To Adopt, Change, or Retain a Tax Year.

Apply for an Employer Identification Number

An EIN is also called a Federal Tax Identification Number. It's used to identify a business. Most businesses need one of these numbers, but some don't. For example, a sole proprietor without employees who doesn't file any excise or pension plan tax returns doesn't need an EIN. The EIN checklist on IRS.gov can help business owners know if they need an EIN. It's important for a business with an EIN to keep the business mailing address, location and responsible party up to date. EIN holders should report changes in the responsible party to the IRS within 60 days.

(Source of quote)

IRS Tax Tip 2023-108

Here are a few things any entrepreneur needs to do when starting their business.

1.Choose a business structure

The form of business determines which income tax return a business needs to file. The most common business structures are:

•Sole proprietorship: An unincorporated business owned by an individual. There's no distinction between the taxpayer and their business.

•Partnership: An unincorporated business with ownership shared between two or more members.

•Corporation: Also known as a C corporation. It's a separate entity owned by shareholders.

•S Corporation: A corporation that elects to pass corporate income, losses, deductions and credits through to the shareholders.

•Limited Liability Company: A business structure allowed by state statute. If a single-member LLC does not elect to be treated as a corporation, the LLC is a "disregarded entity," and the LLC's activities should be reflected on its owner's federal tax return as a sole proprietorship.

Choose a tax year

A tax year is an annual accounting period for keeping records and reporting income and expenses. A new business owner must choose either:

•Calendar year: 12 consecutive months beginning January 1 and ending December 31.

•Fiscal year: 12 consecutive months ending on the last day of any month except December.

If an individual files their first tax return using the calendar tax year and later begins business as a sole proprietor, becomes a partner in a partnership, or becomes a shareholder in an S corporation, they must continue to use a calendar tax year unless they get IRS approval to change it or meet one of the exceptions listed in the instructions to Form 1128, Application To Adopt, Change, or Retain a Tax Year.

Apply for an Employer Identification Number

An EIN is also called a Federal Tax Identification Number. It's used to identify a business. Most businesses need one of these numbers, but some don't. For example, a sole proprietor without employees who doesn't file any excise or pension plan tax returns doesn't need an EIN. The EIN checklist on IRS.gov can help business owners know if they need an EIN. It's important for a business with an EIN to keep the business mailing address, location and responsible party up to date. EIN holders should report changes in the responsible party to the IRS within 60 days.

(Source of quote)

IRS Tax Tip 2023-108

Tax considerations for people who are separating or divorcing [税金]

When couples separate or divorce, the change in their relationship status affects their tax situation. The IRS considers a couple married for tax filing purposes until they get a final decree of divorce or separate maintenance.

Tax treatment of alimony and separate maintenance

•Amounts paid to a spouse or a former spouse under a divorce decree, a separate maintenance decree or a written separation agreement may be alimony or separate maintenance for federal tax purposes.

•Certain alimony or separate maintenance payments are deductible by the payer spouse, and the recipient spouse must include it in income.

Rules related to dependent children and support

Generally, the parent with custody of a child can claim that child on their tax return. If parents split custody fifty-fifty and aren't filing a joint return, they'll have to decide which parent claims the child. If the parents can't agree, taxpayers should refer to the tie-breaker rules in Publication 504, Divorced or Separated Individuals. Child support payments aren't deductible by the payer and aren't taxable to the payee.

Not all payments under a divorce or separation instrument – including a divorce decree, a separate maintenance decree or a written separation agreement – are alimony or separate maintenance. Alimony and separate maintenance doesn't include:

•Child support

•Noncash property settlements – whether in a lump-sum or installments

•Payments that are your spouse's part of community property income

•Payments to keep up the payer's property

•Use of the payer's property

•Voluntary payments

Child support is never deductible and isn't considered income. Additionally, if a divorce or separation instrument provides for alimony and child support and the payer spouse pays less than the total required, the payments apply to child support first. Only the remaining amount is considered alimony.

Report property transfers, if needed

Usually, if a taxpayer transfers property to their spouse or former spouse because of a divorce, there's no recognized gain or loss on the transfer. People may have to report the transaction on a gift tax return.

(Source of quote)

IRS Tax Tip 2023-97

Tax treatment of alimony and separate maintenance

•Amounts paid to a spouse or a former spouse under a divorce decree, a separate maintenance decree or a written separation agreement may be alimony or separate maintenance for federal tax purposes.

•Certain alimony or separate maintenance payments are deductible by the payer spouse, and the recipient spouse must include it in income.

Rules related to dependent children and support

Generally, the parent with custody of a child can claim that child on their tax return. If parents split custody fifty-fifty and aren't filing a joint return, they'll have to decide which parent claims the child. If the parents can't agree, taxpayers should refer to the tie-breaker rules in Publication 504, Divorced or Separated Individuals. Child support payments aren't deductible by the payer and aren't taxable to the payee.

Not all payments under a divorce or separation instrument – including a divorce decree, a separate maintenance decree or a written separation agreement – are alimony or separate maintenance. Alimony and separate maintenance doesn't include:

•Child support

•Noncash property settlements – whether in a lump-sum or installments

•Payments that are your spouse's part of community property income

•Payments to keep up the payer's property

•Use of the payer's property

•Voluntary payments

Child support is never deductible and isn't considered income. Additionally, if a divorce or separation instrument provides for alimony and child support and the payer spouse pays less than the total required, the payments apply to child support first. Only the remaining amount is considered alimony.

Report property transfers, if needed

Usually, if a taxpayer transfers property to their spouse or former spouse because of a divorce, there's no recognized gain or loss on the transfer. People may have to report the transaction on a gift tax return.

(Source of quote)

IRS Tax Tip 2023-97

Things for extension filers to keep in mind as they prepare to file [税金]

Many people requested an extension to file their tax return after the usual April deadline. These filers have until Oct. 16, 2023, to complete and file their tax return. The IRS suggests that those who already have the forms and information they need file now – there's no advantage to waiting until the deadline and filing now saves the worry that they may miss the deadline.

There are a few things extension filers should know as they get ready to file.

File by the deadline

Extension filers should file and pay any balance due by Monday, Oct.16, 2023.

Taxpayers get their refund faster by choosing direct deposit

Anyone due a refund should request direct deposit to get their tax refund electronically deposited into their financial account.

IRS offers payment options for taxpayers with a balance due

Those who owe taxes and can't pay their balance in full should pay as much as they can to reduce interest and penalties for late payment. The IRS has options for people who can't pay their taxes, including applying for a payment plan on IRS.gov. Taxpayers can view payment options or check their account balance online.

Extension filers should request missing or incorrect documents directly from employer or other payers

If a taxpayer is waiting to file because they're missing a form like a W-2 or 1099, they should contact their employer, payer or issuing agency and request a copy of the missing or corrected document. If they still can't get the forms, they may need to use Form 4852 as a substitute.

Taxpayers who didn't file in April and didn't request an extension should still file as soon as possible

Anyone who did not request an extension by this year's April 18 deadline should file and pay as soon as possible. This will stop additional interest and penalties from adding up. There is no penalty for filing a late return for people who are due a refund.

(Source of quote)

IRS Tax Tip 2023-92

There are a few things extension filers should know as they get ready to file.

File by the deadline

Extension filers should file and pay any balance due by Monday, Oct.16, 2023.

Taxpayers get their refund faster by choosing direct deposit

Anyone due a refund should request direct deposit to get their tax refund electronically deposited into their financial account.

IRS offers payment options for taxpayers with a balance due

Those who owe taxes and can't pay their balance in full should pay as much as they can to reduce interest and penalties for late payment. The IRS has options for people who can't pay their taxes, including applying for a payment plan on IRS.gov. Taxpayers can view payment options or check their account balance online.

Extension filers should request missing or incorrect documents directly from employer or other payers

If a taxpayer is waiting to file because they're missing a form like a W-2 or 1099, they should contact their employer, payer or issuing agency and request a copy of the missing or corrected document. If they still can't get the forms, they may need to use Form 4852 as a substitute.

Taxpayers who didn't file in April and didn't request an extension should still file as soon as possible

Anyone who did not request an extension by this year's April 18 deadline should file and pay as soon as possible. This will stop additional interest and penalties from adding up. There is no penalty for filing a late return for people who are due a refund.

(Source of quote)

IRS Tax Tip 2023-92

前の10件 | -